Pacific Media Group's disastrous impact on European football

Worst practices for investing in professional football clubs

AS Nancy Lorraine, a historical French club where our own Michel Platini spent 8 seasons, sadly got relegated to National 2, France's fourth division - their second relegation in a row.

As brilliantly explained by National Basketball Association (NBA) MVP Giannis Antetokounmpo a couple of weeks ago, failure is part of the journey to success. A bad season can happen to any team and athlete.

Humble and willing-to-learn investors have the ability to positively impact the sports ecosystem, as we have been witnessing with RedBird Capital Partners at the Toulouse Football Club, Joseph Oughourlian at Racing Club de Lens, or Jordan Gardner at FC Helsingør.

But as more and more investors target sports and football as relevant asset classes, mistakes will be made and it is essential to shed light on them in order to ensure the long-term sustainability of the ecosystem.

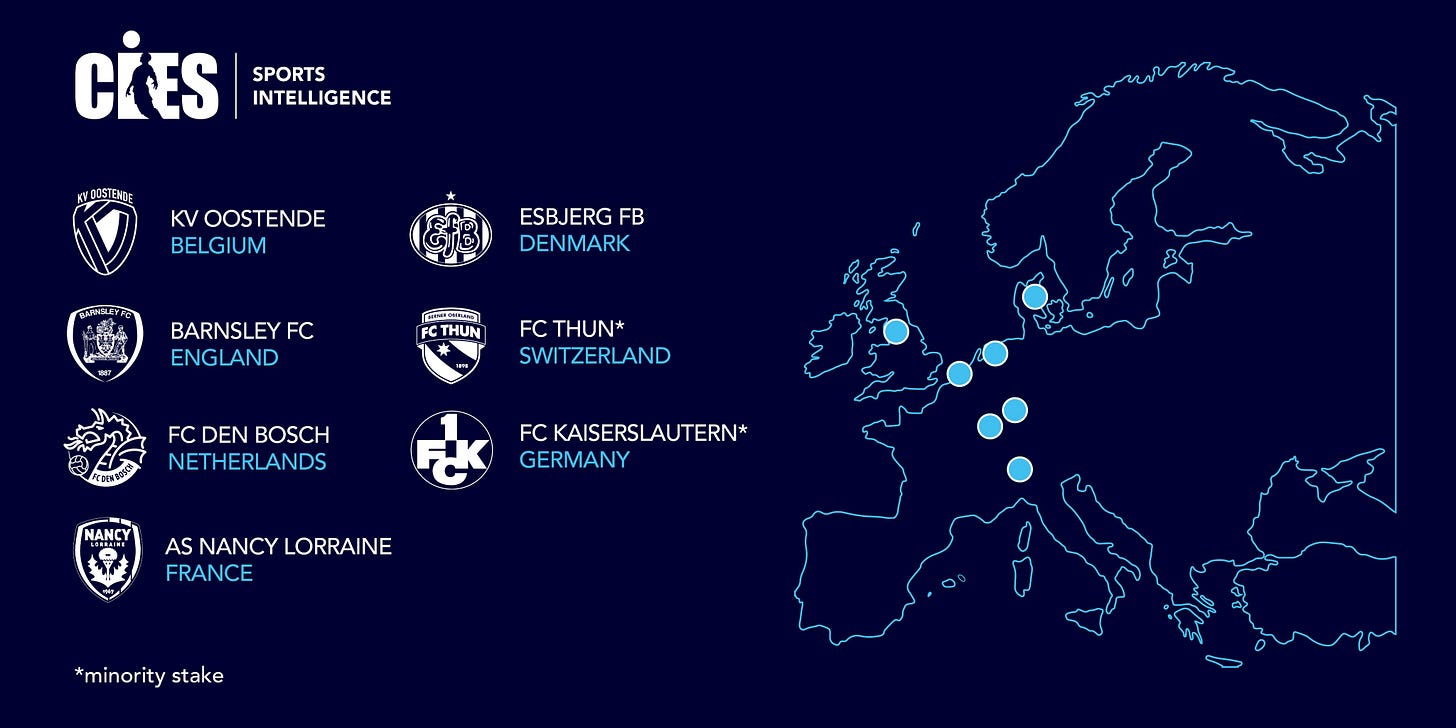

Pacific Media Group / NewCity Capital, a consortium gathering Chinese and US investors including Paul Conway, Chien Lee and Grace Hung, built a multi-club portfolio of 7 European football clubs, with Gauthier Ganaye acting as their go-to guy for club management.

In the view of their results both on and off the pitch, their journey in football does not seem to be running smoothly. They got most of their clubs relegated and are now being pushed away by fans and local communities, without taking any accountability for these repeated failures.

I tried to understand the PMG "model" and synthesize the insights in the article below - this article is not intended as blunt and non-constructive criticism, but as a call for action and a way to open the dialogue on positive and responsible investments in professional football.

Who is behind Pacific Media Group?

What is being shortened as Pacific Media Group (PMG) in the sports media is actually a consortium headed by Chinese billionaire Chien Lee, Founder of NewCity Capital, and Pacific Media Group, which is led by Paul Conway and Grace Hung.

This is basically the only public information available on these two organizations:

Former Oppenheimer & Co. banker Paul Conway first moved to China in 2010 to restructure a company he had just bought for a wealthy client. He spent a couple of years helping Chinese companies do business in the US, and vice-versa. In 2013, he set up a hedge fund with Chien Lee, a US-based Chinese entrepreneur who owned a successful hotel chain, before launching his own firm with Hong Kong-based businesswoman Grace Hung in 2014, Pacific Media Group (PMG).

The Conway, Lee and Hung trio started investing together in the Asian entertainment sector, including films as well as a portfolio of cartoons for the Chinese market, video games and merchandising spin-offs.

Later on, other investors will join the consortium, including Chinese hotelier Alex Zheng as well as Indian investor and Krishen Sud. Tampa Bay Rays co-owner Randy Frankel, and former Rays executive Michael Kalt, gathered in a family office called Partners Path Capital, also joined the group on specific club acquisitions.

And finally, they elected quite early on the profile who would become their go-to guy to run the clubs they invested in: Gauthier Ganaye. Quite a lot to say about him, but let’s come back to that later

Pacific Media Group's entry into European football: A shopping spree for wealthy and American and Chinese financiers

Over the past 7 years, PMG has acquired stakes in no less than 8 clubs, and sold one of them - they now own a “multi-club portfolio” of 7 clubs. Let’s take a look at their deal-making timeline:

From “Côte d’Azur” to South Yorkshire

In June 2016, Chien Lee and Paul Conway acquired 80% of OGC Nice (France’s Ligue 1), where they both took a seat at the Board, with club President Jean-Pierre Rivère retaining a 20% stake. The value of the deal was not disclosed at the time, but reports mentioned a €23 million valuation. While not directly linked to the Chinese government, this acquisition happened in the context of massive Chinese investments in European football, with Chinese investors injecting more than $2.5 billion into European football clubs between 2014 and 2017, from top 30 teams like AC Milan and Inter Milan to tier-2 teams such as AJ Auxerre and FC Sochaux-Montbéliard in France.

Lee and his co-investors then spent several months scanning the market for new club acquisition opportunities, especially in the UK. They held discussions with Hull City FC, Middlesbrough FC, and even with Matthew Benham’s Brentford FC which had the advantage of being close to Heathrow Airport. In December 2017, they finally found their target and acquired a 80% stake in Barnsley FC from long-time owner Patrick Cryne, at a reported £6.3 million valuation. Lee and Conway were appointed Co-Chairmen of the club, while the official press release also announced the arrival of Moneyball’s Billy Beane as new investors alongside Pacific Media Group.

OGC Nice, a winning cash-out

At that time, everything was running smoothly for the PMG team. They had just finished a successful 2016/17 season with Lucien Favre’s OGC Nice qualifying for the Champions League for the first time in their history (although they did not make it past the qualifying round to the group stage).

Now let us fast-forward 2 years to the end of 2019. Sir Jim Ratcliffe, Chairman of chemicals group INEOS and Britain’s richest man, made quite an entrance in French football by acquiring OGC Nice from PMG for €100 million, the most expensive club acquisition in French history at the time. As a comparison, Olympique de Marseille had been sold to Frank McCourt for €45 million in 2016. By valuing OGC Nice close to 5 times what PMG had paid only 3 years before, Ratcliffe effectively - and hopefully involuntarily - funded the development of the PMG network. Conway tried to build on this successful sale to try and onboard new co-investors in the US. He found there Randy Frankel, Michael Kalt and Krishen Sud, who would help accelerate the rhythm of acquisitions during the following months. PMG acquired no less than 6 clubs in less than 2 years and a half:

November 2019: FC Thun (Switzerland)

April 2020: KV Oostende (Belgium)

January 2021: AS Nancy-Lorraine (France)

March 2021: Esbjerg fB (Denmark)

September 2021: FC Den Bosch (Netherlands)

March 2022: 1. FC Kaiserlautern (Germany)

Having sold OGC Nice, PMG ended up owning a portfolio of 7 European football clubs. To what end?

German coaches, young players, and data obsession: Pacific Media Group’s “magic formula” to disrupt European football

In 2018, probably (too) proud of the one and only good season they had with OGC Nice in Ligue 1 in 2016/17 and Barnsley FC in League One (England’s third division) in 2018/19, Paul Conway started laying out PMG’s visionary strategy to the media. In an interview to Off The Pitch, he declared: "For all the clubs we get involved with, for the first couple of years the biggest focus by far is rebuilding the squad in the strategy and style that we like. Which is commitment to youth, commitment to academy, high press and generating transfer profits to reinvest in the squad." More broadly speaking, they identified several characteristics which they would then try and replicate across all of their clubs: (i) showing a consistent high pressing style of play led by young German coaches, (ii) betting on young players, and (iii) relying on data analytics to leverage the inefficiencies of the transfer market.

An army of Jürgen Klopp replicas and a fascination for “gegenpressing”

The first thing which quickly appeared obvious with PMG’s strategy: they absolutely adore German coaches. Probably because Jürgen Klopp was becoming the talk of the town back then, joining Liverpool FC in October 2015 after an incredible journey at Borussia Dortmund. It was indeed tempting to follow the "gegenpressing" craze after watching a couple of Dortmund and Liverpool games. Hiring unknown German coaches to implement this playing style became their systematic approach:

Barnsley FC: The 44-year-old Daniel Stendel was appointed as Head Coach in June 2018 for PMG’s first full season as club owners. He was sacked in October 2019 after a series of bad results.

Esbjerg fB: Peter Hyballa became the Head Coach in May 2021, 2 months after PMG officially acquired the club. He resigned a few months later amid clashes with first-team players and reports of physical and mental abuse.

KV Oostende: Same story again, with counter-pressing specialist from RB Leipzig’s academy Alexander Blessin being appointed at the start of the 2020/21 season.

AS Nancy-Lorraine: Now apparently specializing in recycling, PMG chose to appoint former Barnsley’s manager Daniel Stendel Head Coach at Nancy in May 2021 - again, only a couple of months after having taken over the club. He was sacked in late September 2021 after 10 match days, without any success.

Talking to Off The Pitch about their entry in Belgian football in 2021, Paul Conway said: “We saw that clubs in Belgium did not press so there was our opportunity, because we may not be able to afford the most technical players, but we can afford really good, young athletes.". Probably a bit simplistic, but it was how this approach naturally led them to push older players out of the squad and replace them by these “young athletes”.

Forever young

A second pillar to the group's strategy is a "ruthless commitment to young players", as explained by Sportico’s JohnWallStreet in 2021. PMG chose from the beginning to only focus on players under 24 years old, in an attempt to ensure profitability in the transfer market. Shortly after acquiring KV Oostende, they decided to rebuilding the squad by signing 12 new young players in 30 days. Still quoted by Sportico, Conway declared at the time that they “rarely signed players over the age of 23. And that’s hard, because the industry [believes] a team needs older leaders to balance out a [young] squad. But we’ve done a lot of empirical research on it, and that is just not true.” To be honest, I would be curious to see this empirical research as I firmly believe that a complex combination of youth AND experience is eventually what allows to build a balanced football team and group of players. Focusing only on young players is a short-term attempt to make a quick bucks on the transfer market. It prioritizes transfer profits, which are by essence non-recurring, at the expense of a stable sporting performance which generates recurring media and commercial revenues, thus harming the long-term financial sustainability of the clubs.

The data-driven extreme

When PMG acquired Barnsley FC, the media reported that Billy Beane had joined the investment consortium, and that he would be advising PMG on how to leverage player data for recruitment purposes. But here again, as with German coaches and young players, they chose a way too radical approach. They explained how they would be prioritizing data-driven insights over traditional scouting methods. Having talked to many sports recruitment experts, I am far from convinced that this is the way to go. Success lays in a hybrid model leveraging both data and the lifelong experience of on-the-ground scouts. RedBird Capital Partners, who had been spending a lot of time and resources on building one of the most advanced sports data company, Zelus Analytics, rightfully understood this point when they acquired Toulouse. They relied on a combination of data-driven insights and “traditional scouting” to reduce the margin of error when identifying and assessing the qualities of a player. In an article by The Athletic’s Matt Slater, Gauthier Ganaye described PMG’s competitive advantage as follows: “We make decisions in minutes that other clubs spend days thinking about. Our dedication to data, our recruitment, our style of play, they are almost automatic now.” Scouting and recruiting a professional football player is a decision which will lead to signing a six-digit contract and impact the whole season of a multi-million budget organization. How can the speed of decision be the only indicator to build your approach on? How can you confidently hire a player which you only know through video and data analysis? In which industry did they see that approach work? In any business, data is becoming a key decision-making tool. But it cannot be the only one, especially in an industry as volatile as professional sports.

The questions we already know the answer to: how are things working for PMG?

Two lenses allow to evaluate the performance of a professional sports organization: the sporting side (i.e., the results), and the business side (i.e., the financial performance).

Breaking all the relegation records in European football

No need for a PhD in Sports Performance to understand how the PMG strategy has been working out for their clubs over the past few seasons. They had a positive first season with OGC Nice, which was already coached by the experienced and former Bundesliga coach Lucien Favre when they arrived. But no noteworthy performance at the club came after that. They managed to get Barnsley FC promoted from League One to the Championship, but the club has been struggling in the bottom of the Championship for the past 4 years. In the 2021/22 season alone, the PMG multi-club project hit a new low by amazingly succeeding to get Barnsley FC, AS Nancy-Lorraine, and Esbjerg fB relegated at the same time. At the end of this season, Barnsley FC announced that Co-Chairmen Paul Conway and Chien Lee were leaving the club's board with immediate effect, alongside Board Directors Dickson Lee and Grace Hung. And a couple of weeks ago, we learnt that Nancy would be relegated for the second time in a row, this time ending in National 2, France’s fourth division.

But beyond on-the-pitch results, which can happen to any club owner, what is striking is the apparent lack of accountability from PMG executives. Gauthier Ganaye, who has been PMG’s “Club CEO in Chief” since day one, ended up running two clubs at the same time. When PMG acquired Nancy, they announced that Ganaye would continue as CEO of KV Oostende, while also running Nancy. He declared back then: “This does not mean that I will quit or reduce my tasks in Oostende. The fact that a new club is added to the consortium also means more sporting and economic possibilities for the KVO.” Yet, Ganaye progressively disappeared from the Directors’ boxes of both stadiums following months of bad results. All stakeholders have been asking for an immediate change for months. Fans from Barnsley and Nancy even ended up forming an alliance (!) to demand that Paul Conway and Gauthier Ganaye stopped hiding from them and actually acted as the club executives they were supposed (and paid) to be. Sports Gazette's Josh Sim collected last year testimonies from Nancy fans: “Club President Gauthier Ganaye stubbornly tried to use data and gegenpressing. Neither one nor the other worked. He has also deserted the place, having not been seen at the stadium or training ground for nine months." Ex-owner and President Jacques Rousselot said in April 2022: “We no longer recognise our club. It is sad to see Nancy in this state… We’ve been fooled by their communication and their false promises, like they’ve fooled the supporters.” Ganaye went from running two clubs to hiding from both of them. Sharing a single CEO across several clubs probably was PMG’s weirdest idea by far. They were surely inspired by the massive number of CEOs successfully running two companies at a time, or the great examples of Presidents easily managing two countries (please note the light touch of sarcasm here).

Financial mayhem

To be fair, PMG were not and will not be the only investors to experience on-the-pitch failure in professional football. What is way more difficult to understand is how they managed to make things consistently worse across all of their clubs from a financial standpoint. It is true that clubs such as KV Oostende and AS Nancy-Lorraine already were loss-making when PMG acquired them. But so are the majority of professional football clubs worldwide. Conway declared in Off The Pitch about Nancy that PMG invested in a club it knew was under a transfer ban and "losing over €5 million a year for years" - well, the Toulouse Football Club had been losing an average €10 million a year for the past 10 years when RedBird purchased the club. The responsibility of new owners, especially when talking about top-notch financial profiles such as Paul Conway, should be to focus on the financial sustainability of the clubs they invest in. This means reaching breakeven before player trading benefits. Spending what you generate is the first rule of budgetary management, and there is no reason it should not apply to professional football clubs.

However, it seems PMG’s main focus has been way more on maximizing short-term profitability through player trading than on laying the basis for solid and recurring revenue generation. Few long-term investments have been made in the stadiums, brand platform, and fan experience. Meanwhile, they pushed their commitment to data and young players to the extreme in order to maximize their gains on the transfer market, and to balance financial accounts between their different clubs. A few weeks ago, news of financial mismanagement at KV Oostende came public (as reported by HLN, Voetbalkrantand) and revealed that the club was failing to pay staff and suppliers, with hotels denying the club bookings because payments were not being made or being done so late. These reports were immediately denied by the Board. But dubious transfer moves also caught the attention of the fans and media. Last season, Oostende spent €5 million on Mickael Biron, who played for AS Nancy-Lorraine and was instantly sent back there on loan. Biron was just one of a number of players that the club signed and then loaned out to their French team. More recently, Arthur Theate, Andrew Hjulsager and Jack Hendry netted the club around €15 million in transfer fees, yet these cash inflows were reportedly used to support loss-making Nancy.

What's next? Time to stop, gents.

In any industry, in any business, transformation takes time. It is not about coming into an organization and brutally executing a strategy which has been defined outside-in. Building a strategy should be done together with all of the club’s staff members, and aiming at seeking alignment with fans and local stakeholders. And when it comes to implementation, it is absolutely essential to empower not only the President but the club’s managers and operational teams to collectively execute the strategy.

Unfortunately, in all the clubs they acquired, PMG were apparently - and from what I heard from club employees - pushing unilaterally their 3-pillar strategy rather than onboarding the stakeholders alongside them in this journey. This is exactly the opposite of what we tried to do when we arrived at the Toulouse Football Club after it had been acquired by RedBird Capital Partners. Our first priority back then was to interview all the club’s football, business, and administrative staff members in order to understand their background, their aspirations and what ideas they had for the club moving forward. We were there to improve the organization from a people / tools / processes perspective and to provide the teams with the time and resources they needed to finally make these ideas come true.

Any investor entering a market he/she did not know should show some humility and willingness to learn about the sector and its characteristics. No one knows an industry before having had the opportunity to actually work in it and spending time with more experienced people than them. From an outside-in perspective at least, it is difficult to see how any of the PMG clubs has made any substantial progress since the day they were acquired. But rather than reflecting on the mistakes they probably made, which would have at least shown some respect to the complexity of the football ecosystem, PMG kept pushing their ambitions higher and higher. One year ago, Paul Conway's "Counter Press Acquisition Corporation", a Special Purpose Acquisition Company (SPAC), raised $75 million in its public offering in the US to acquire stakes in the sports, media and data analytics industries. It was understood that their plan was to invest in a top-tier club with a valuation of $250 million to $500 million. Scary. But in February 2023, Counter Press announced its intention to dissolve and liquidate as it was not able to find a target within the required timeframe.

It is hard to anticipate what the future holds for PMG and their 7 European football clubs. Gauthier Ganaye recently left KV Oostende and AS Nancy-Lorraine to join another US multi-club organization, John Textor’s Eagle Football Holdings - which owns stakes in Crystal Palace FC, Olympique Lyonnais, RWD Molenbeek, and Botafogo. The Athletic reported that KV Oostende, “recently relegated to the second tier of Belgian football after a decade in the top flight” was up for sale for £10 million, with Newcastle United and Wolverhampton’s owners (respectively Saudi Arabia’s Public Investment Fund and the Chinese consortium Fosun) potentially willing to acquire the club. Could PMG be considering an exit from football? It does not seem so, as Chien Lee announced in April the acquisition of the Polish side GKS Tychy, while being reportedly looking to acquire a club in Austria. The Athletic’s Matt Slater quoted Jordan Gardner, former co-owner of Danish second-tier team FC Helsingør, in a brilliant column last year: “Investors should focus on one club, understand how to run that club well and efficiently before even thinking of expanding beyond that.”

Meanwhile, fan protests keep growing stronger across all of the PMG-owned clubs. The Athletic’s Matt Slater noted in a brilliant column last year that “pinned at the top of the Fans of Nancy Twitter page is a 45-tweet thread that recounts the rows, failed managerial experiments, league investigations into the club’s transfer dealings and many defeats”. In one of his latest public declarations to indirectly address these protests, Paul Conway simply declared: "Sometimes disruption is painful". Well, especially when it comes with the wrong attitude, Mr. Conway.

Sources

https://theathletic.com/3135274/2022/02/19/does-owning-multiple-clubs-actually-work/

https://www.sportico.com/leagues/soccer/2021/barnsley-premier-league-promotion-1234628851/

https://www.barnsleyfc.co.uk/news/2022/may/club-statement-new-board-of-directors/

https://theathletic.com/4432985/2023/04/20/newcastle-united-kv-oostende/